Last week the USD closed at a near 7-month low, the EUR, JPY, crude oil saw some gains. At the start of this week’s trading day predictions were grim and traders are scrambling to get some sense as to where to place investments. As such, traders are clearly anticipating the release of relevant indicators such as Germany’s economic figures, home sales, Philly Fed Manufacturing Index, etc.

Mixed Signals for the Greenback

First, the good news; the USD is slowly correcting itself with some gains at the close of the trading day. This includes but is not limited to:

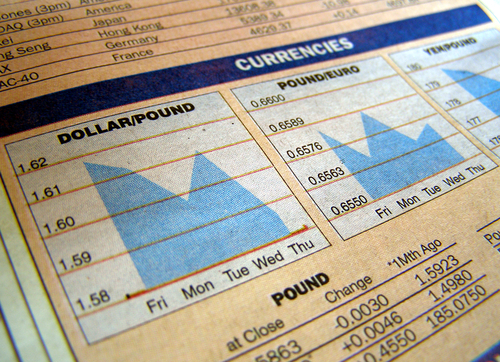

- GBP/USD falling from 0.15% to 1.6220

- EUR/USD at 1.3067 which is 0.15% higher

- AUD/USD at 1.0465 which is 0.08% higher

- Home sales are up by 7.8%. Expectations were at most 2.0% so 7.8% is a welcome surprise.

Next come the bad news, with the USD trading lower on more fronts. This includes but is not limited to:

- USD/JPY at 78.38 which translates to a 0.55% drop

- AUD/USD at 1.0465 meaning 0.08% gains for AUD

- NZD/USD 0.8283 meaning 0.14% gains for NZD

- USD Index has the USD slipping .15% and trading at 79.15. This is as opposed to six other major currencies.

- Building permits issued fell 1%. This is not so bad considering the expectation was 1.8% decrease.

No to Watered Down Recovery!

Surprisingly enough the EUR gained valuable ground at the close of last week’s trading. However the EUR is bleeding gains fueling speculation that the same has peaked. Some analysts find fault at rumors of a move from German legislators to water down Euro zone economic recovery plans. Since it was the positive outlook on the same economic plan that got the EUR to 1.31 last week and Germany is Euro’s largest economy, well you do the math. If that was not bad enough, the figures are out and the US has met a few of its targets. This means a stronger USD and a weaker EUR. Traders should look out for indicators relevant to:

- Actual steps to modify Euro-zone economic recovery

- Germany related economic figures.

Doing Good but not Good Enough

JPY has a lot going for it this week. First, the Bank of Japan (BOJ) overshot its asset purchase expectations. Second, EUR is so down it cannot help but help the JPY. Third, US housing data is positive. In addition the BOJ seems to have a less aggressive but more dynamic banking policy vis a vis other relevant central banks.

On the other hand Gold is at a downward correction stage after some speculate that it has gone into overbought territory. Investors in gold are positive particularly since the US economy has a positive outlook after the release of home sales and building permit figures. Investors have to pay attention to EUR relate news, especially the much anticipated German economic figures.

In Closing

All in all investors are in for a great trading week. Paying special attention to any information relevant to the EUR is a must. There is no demand for safe haven assets this week since the market is up for some risky trading.