Understanding financial market movements can be challenging, but traders have developed various tools to make sense of price trends. One of the most insightful tools is the Elliott Wave Theory, formulated by Ralph Nelson Elliott in the 1930s. This theory claims that market prices follow a structured pattern influenced by the psychology of market participants. The patterns, known as “waves,” help traders anticipate market shifts and make informed decisions. In this article, we’ll explore how Elliott Wave Theory works, its key concepts, and how traders apply it to forecast market trends.

The Basics of Elliott Wave Theory

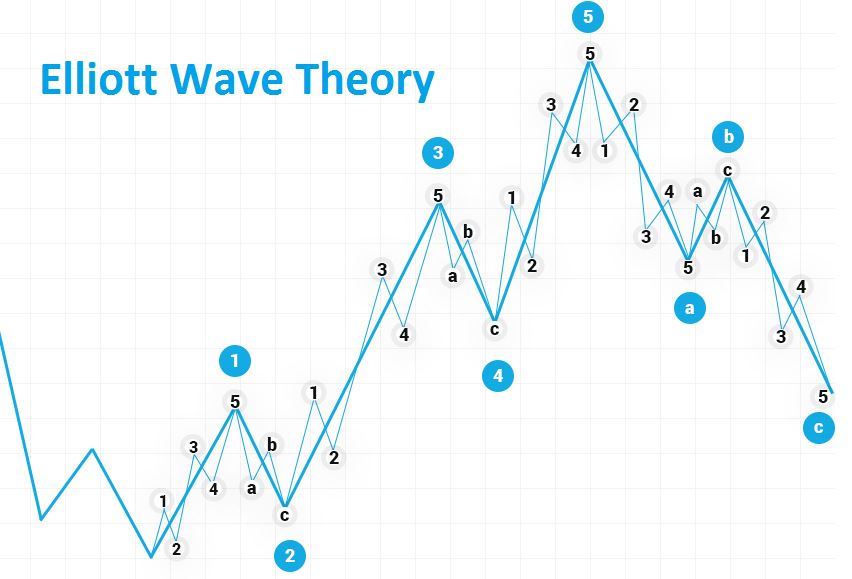

At its essence, Elliott Wave Theory suggests that market prices move in cyclical, identifiable waves. These waves are influenced by the emotions of investors, such as optimism, fear, and greed. The theory breaks down price movements into two primary categories: impulse waves and corrective waves.

Impulse Waves: These are the main price movements that follow the trend. They consist of five waves, where three waves (1, 3, and 5) move in the direction of the trend, and two waves (2 and 4) represent pullbacks.

Corrective Waves are movements that go against the prevailing trend and consist of three smaller waves labeled A, B, and C, signaling a brief market correction.

The Structure of 5-Wave and 3-Wave Patterns

The Elliott Wave model is built around a repeating cycle of five waves in the direction of the trend, followed by a corrective three-wave pattern. Here’s how these patterns typically unfold:

Impulse Waves (Five-Wave Sequence):

- Wave 1: The market begins to move in the direction of the new trend as early traders enter.

- Wave 2: The market pulls back slightly as some traders sell off to lock in profits.

- Wave 3: This is usually the strongest and longest wave, driven by a broader group of traders recognizing the trend.

- Wave 4: typically involves a smaller retracement, showing less intensity than the earlier Wave 2 pullback.

- Wave 5: The final surge in the trend, driven by euphoria or overconfidence.

Corrective Waves (Three-Wave Sequence):

- Wave A: The market begins to decline after reaching the top, signaling the start of a correction.

- Wave B: A temporary rally that can give the impression the trend might resume.

- Wave C: The final drop, completing the correction phase.

The Fractal Nature of Elliott Wave Theory

One of the key characteristics of Elliott Wave Theory is its fractal structure. A fractal pattern means that these wave formations repeat on different timeframes, whether you’re looking at short-term charts or long-term trends. For example, a five-wave pattern may appear on an hourly chart, while the same structure can be seen on a daily or weekly chart.

This fractal nature makes Elliott Wave Theory flexible for various trading strategies. Day traders can use it to analyze short-term price movements, while long-term investors can apply it to spot larger market cycles.

Fibonacci Ratios and Elliott Wave Theory

Fibonacci ratios are closely tied to Elliott Wave Theory and play a key role in predicting price retracements and targets. These ratios, like 38.2%, 50%, and 61.8%, are derived from the Fibonacci sequence and are often used to anticipate how far a correction or trend might go.

For example, after a strong wave 1 movement, a wave 2 pullback might retrace around 50% or 61.8% of the initial upward move. Traders apply these Fibonacci levels to pinpoint potential support and resistance zones, helping them make better-informed entry or exit decisions during trends or corrections.

Market Psychology in Elliott Waves

At the heart of Elliott Wave Theory is the reflection of market psychology. The waves capture the emotional shifts among market participants, from optimism to skepticism, and eventually to fear or greed.

- Wave 1 begins as a small group of traders spot an opportunity and start buying.

- Wave 2 marks a correction as early traders take profits, causing hesitation among other market participants.

- Wave 3 is driven by increasing optimism, as more traders recognize the emerging trend.

- Wave 4 reflects caution, with a slight pullback from overextended prices.

- Wave 5 often represents the peak of optimism, where market participants become overly confident or euphoric, often leading to the corrective waves that follow.

Understanding these psychological phases helps traders anticipate shifts in sentiment and market direction.

How to Use Elliott Wave Theory in Trading

Applying Elliott Wave Theory to real-time trading requires practice and often involves combining it with other technical analysis tools. These levels serve as crucial points for determining when to enter or exit trades.

- Identify the Trend: Determine whether the market is in a bullish or bearish trend. Identifying the overall trend helps you map out the wave patterns accurately.

- Label the Waves: Traders try to mark the different waves as they develop. It can be tricky to do this in real-time, but looking at multiple timeframes can help confirm the wave counts.

- Use Fibonacci Levels: Apply Fibonacci retracement and extension levels to predict how far a price correction or trend might go. These levels act as key decision points for entering or exiting trades.

- Combine with Other Indicators: Use other technical indicators like moving averages or trendlines to complement your wave analysis. This combination helps verify signals and increases accuracy.

Challenges and Limitations

Despite its widespread use, Elliott Wave Theory does come with limitations. One of the main drawbacks is its subjectivity. Different traders may interpret the same chart differently, leading to varied wave counts and forecasts. Additionally, unexpected market events, such as political developments or economic reports, can disrupt wave patterns, making them less reliable.

Because of these limitations, it’s essential to use Elliott Wave Theory alongside other forms of analysis to improve the reliability of your market predictions.

Conclusion The Elliott Wave Theory is a powerful tool for predicting market trends, offering traders insight into the behavior and psychology driving price movements. Its structured wave patterns, fractal nature, and integration with Fibonacci ratios make it a versatile approach for analyzing markets.