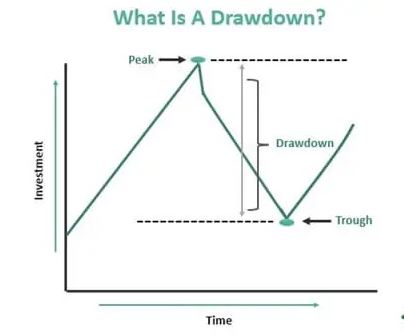

Investment, trading accounts, or fund drawdowns are defined as declines from a peak to a trough during a period. A drawdown measures the historical risk of different investments, fund performance, or trading performance. Usually, it calculates as a percentage of the peak to the subsequent trough. In the case of a $10,000 trading account with funds dropping to $9,000 before regaining $10,000, the trading account experienced a 10% loss.

What Is The Best Way To Measure Drawdown?

An absolute drawdown, relative drawdown, and maximum drawdown can all be used in top-down analysis to evaluate the past performance of a trading strategy.

In determining how much capital can be lost if we use a certain trading system, we can measure the types of drawdown.

How To Control Drawdowns In Trading

You can still experience drawdowns no matter how long you have been trading. They say you can’t teach an old dog new tricks, but trading in the forex market never really stops learning. In other words, no matter how new you are to trading or how experienced you are, you can still learn new trading strategies to recover from losing streaks and better control drawdowns.

Undoubtedly, the most important thing to remember is to avoid large drawdowns. Large drawdowns are among the worst things that can happen, and losing money is never fun.

Let’s get started with the trader’s guide to dealing with drawdowns (3 drawdown trading strategies):

#1. Manage Drawdown by using the 2% Rule

Forex traders should only use 2% of their capital on any given trade and keep their risk low.

It is a common scenario that two traders start with $10,000, and both lose five trades. However, one trader risks only 2% per trade, and the other takes a 5% risk. The first trader suffered a loss of 9.6% in this case, whereas the second trader suffered a loss of more than double (22.6%).

For the first trader, he would need an increase of 11 per cent to get back his losses, whereas, for the second trader, a gain of approximately 30 per cent would be required to break even.

#2. Take Emotional Control of DD Ups and Downs

To succeed in trading for a long time, you have to learn to deal with the emotional turmoil accompanying drawdowns. You must hold yourself accountable for your forex trades and determine a course of action to correct your mistakes. The first step is to take responsibility for your own trading decisions.

There is no instant solution to large drawdowns, but they all start with a smaller drop in your account equity curve. When real money is on the line, a drawdown can cause emotional turmoil for many traders. As a result, more trading mistakes are usually committed, and bigger drawdowns are usually experienced.

You can limit the losses you will take in the future if you know how to control your emotions during a drawdown. When emotionally detached from your losses, it is extremely helpful to step back for 1-2 weeks, clear your mind, and come back later with a fresh perspective. While trading breaks might seem redundant, they allow us to regain control of our emotions, trading strategy, and trading plan.

Depending on Myopic loss aversion, you are more likely to withdraw from risk if you do not see information about the drawdown often. So, if you rarely check your PnL, you are more likely to be emotionally detached from losses.

#3. Take One Trade at a Time

Limiting your forex trading activity to just one trade at a time is best to minimize drawdown. With a level of risk of 2% per trade, you will only lose 2% in worst-case scenarios if you take just one trade at a time. You can trade only that currency pair if you know which one you prefer (EUR/USD, GBP/USD, etc.).

Final Thoughts

When it comes to forex trading, you need to keep drawdown under control if you want to be successful over the long term and not burn out your account too soon. To cope better with drawdowns, you should incorporate some of the techniques in this drawdown trading guide into your trading plan. Everyone deals with drawdowns once in a while.