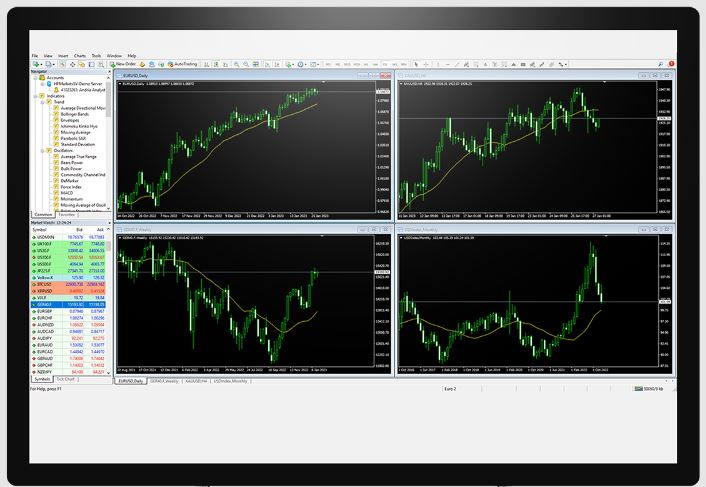

MetaTrader 4 (MT4) has become a familiar name in the world of forex trading and investment. But MT4 offers far more than just price charts. It provides a powerful toolbox of drawing tools that transform charts from static data points into dynamic landscapes rich with valuable insights. This beginner’s guide unpacks the world of MT4’s drawing tools, giving you the knowledge and skills to navigate the market with greater confidence.

Visualization is Key: Why Drawing Tools Matter

Imagine navigating a battlefield shrouded in fog. Making strategic decisions without intelligence is impossible. Technical analysis in trading relies heavily on clear visualization, and MT4’s drawing tools become your virtual map. These tools illuminate trends, support and resistance zones, and potential price patterns, allowing you to:

- Unmask Trends: Trendlines, formed by connecting key price points, reveal the market’s overall direction (uptrend or downtrend). This knowledge empowers you to identify potential buying or selling opportunities based on the trend’s continuation.

- Demarcate Support and Resistance: Horizontal lines highlight historical price points where prices have typically bounced back (support) or encountered selling pressure (resistance). These zones can offer clues about future price behavior.

- Decipher Chart Patterns: Combining trendlines, horizontal lines, and geometric shapes like channels and triangles allows you to identify recurring chart patterns. These patterns can foreshadow potential price movements, aiding in informed trading decisions.

- Strategize Entries and Exits: Drawing tools help visualize potential entry and exit points for your trades based on your analysis of trends, support/resistance, and chart patterns. This empowers you to plan your trades with greater precision and manage risk effectively.

- Monitor Progress: Annotations and arrows allow you to document your analysis and track how prices interact with your drawn objects. This ongoing dialogue with the market refines your understanding over time and helps you identify areas where your analysis might need refinement.

Unlocking the Toolbox: Essential Drawing Tools in MT4

MT4 offers a diverse array of drawing tools, each catering to specific analytical needs. Let’s delve into a selection of the most crucial ones:

- Trendlines: These slanted lines, connecting two or more price points, depict the market’s overall uptrend (rising line) or downtrend (falling line).

- Horizontal Lines: Drawn parallel to the price axis, these lines highlight historical support and resistance levels.

- Channels: Channels are formed by two parallel trendlines, one above and one below the price action. Rising channels suggest an upward bias, while falling channels indicate a downward trend, both suggesting price confinement within a specific range.

- Fibonacci Retracements: This tool overlays a series of horizontal lines based on the Fibonacci sequence. These lines highlight potential retracement areas after a strong price move, aiding in identifying potential reversal or continuation points.

Mastering the Art: Practical Tips for Using Drawing Tools

While MT4 provides the tools, mastering their use requires dedication and a strategic approach. Here are some most important practical tips to get you started:

- Start Simple: Begin with fundamental tools like trendlines and horizontal lines before venturing into more complex patterns.

- Synergy is Key: Don’t rely on just one tool. Combine various tools for a more comprehensive understanding of the market dynamics.

- Respect History: Remember, drawing tools offer insights, not guarantees. Base your trading decisions on a confluence of factors, including fundamental analysis alongside your technical analysis using drawing tools.

- Practice Makes Perfect: Experiment with different drawing tools on various charts. The more you practice, the more comfortable and confident you will become in applying them effectively.

- Backtesting is Crucial: Test your drawing-based trading strategies on historical data to assess their effectiveness before risking real capital. This helps refine your approach and manage risk.

Conclusion MT4’s drawing tools are a valuable asset for any trader. By understanding their functionalities and applying them strategically, you can glean valuable insights from your charts, identify potential trading opportunities, and refine your overall trading strategy. Bear in mind, these tools serve as merely one element in the larger scheme of things. Always combine technical analysis with other forms of market research and maintain sound risk management practices. With dedication and a dash of creativity, MT4’s drawing tools can empower you to navigate the ever-changing market landscape with greater confidence and clarity.