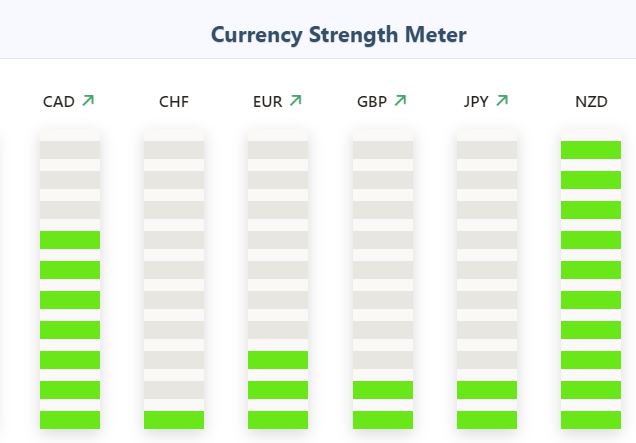

Currency Strength Meter Indicators prevent unnecessary hedging and double exposure and determine your trade’s risk level.

What is the currency strength meter?

A currency meter measures the strength of 28 crosses between the main currencies in the Forex market (USD, GBP, EUR, CHF, JPY, CAD, NZD, and AUD) if you are still getting used to it. A forex trader can use it to determine whether market conditions positively or negatively impact their positions.

With the help of this technical indicator, traders can make informed decisions about their trading.

A five-step process is involved:

1. Determine the base currency

2. Select a currency pair that matches the base currency

3. Determine the relative strength of each currency pair

4. Calculate the average score

5. Use the results to improve your business

It is essential to determine whether the US dollar is strong or weak, using the strength meter to make decisions.

It’s also important to note that a particular currency’s strength largely depends on its use time. For example, the EUR can be strong today but among the strongest over extended periods.

Advantages of Currency Strength Indicators

The three main advantages of currency strength indicators are as follows.

Double exposure protection

If you trade multiple times on highly correlated pairs, you will be overtrading since they move in the same direction. In such a situation, you will lose money if the market does not move in your favor. For example, AUD/JPY, EUR/JPY, and AUD/CHF are highly correlated currencies, meaning that your exposure could be doubled.

Double exposure to JPY and AUD will result in a huge loss if the market moves against your expectations. If you trade weak currencies, you can avoid double exposure by avoiding trading weak currencies. A Forex currency strength indicator will warn you of such exposure by showing highly correlated currencies as a graphic.

Prevents Needless Hedging

It is generally beneficial for traders to be aware in advance of the correlations between various pairs of currencies. Consider, for instance, the negative correlation between USD/CHF and EUR/USD.

If you know that these currencies are negatively correlated, you will know that their market movements will be opposite in advance. Currency strength meters prevent you from unnecessary hedging because if you trade both pairs long, you may lose one trade but win another.

Identify High-Risk Trades

A currency strength meter can also help you determine the level of risk involved with going long on the currency pair GBP/USD and EUR/USD. If one currency is stronger than the other, there is a positive correlation between the two currencies, which indicates a double-risk situation.

A trader should avoid trading correlated pairs with opposing market movements if one currency indicates strong market movement while the other displays a range.

Suppose EUR/USD falls rapidly while GBP/USD is range bound; one shouldn’t take long on the latter, as the USD might strengthen.

Final words

Online trading relies on the principle that the tools used to trade should produce a profit over time. Currency strength meters are no different. Often, risk is overlooked when using new, fancy tools. Foreign exchange trading involves knowing that the market is highly volatile, meaning an asset can break down quickly. To open a position, analyzing an asset from both a technical and a fundamental perspective is important.