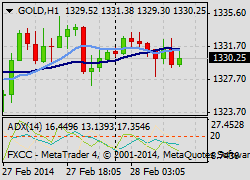

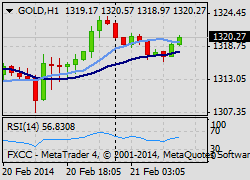

The ADX, the average directional index. How to use it and when

Moving on in the series regarding the swing trading indicators that we favour using in our “is the trend still your friend?” weekly trend trading analysis articles we now come to the ADX… One of the simplest indicators to use it’s not only much maligned, but also misunderstood and rarely used, or used correctly by […]

The ADX, the average directional index. How to use it and when Read More »