In the world of trading, there’s a tactic gaining attention called mean reversion. But what exactly does reversion mean, and how can it help traders make money? In this guide, we’ll take a close look at mean reversion trading techniques, breaking down what it is, how it works, and how to use it effectively.

Understanding Mean Reversion

Mean reversion is a trading tactic that says prices tend to return to their average over time. This means if a price goes too high or too low, it’s likely to bounce back to its usual level. It’s like a rubber band – stretch it too far, and it snaps back.

Spotting Mean Reversion Chances

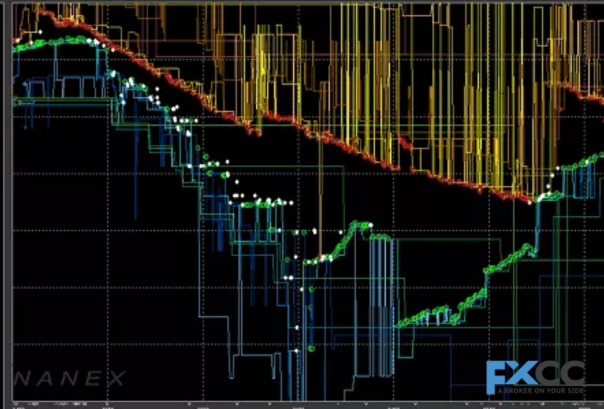

To use mean reversion, you’ve got to find instances where prices are way off from their average. You can do this by looking at charts and using tools like Bollinger Bands, moving averages, and RSI. These tools help you see when prices are unusually high or low compared to their usual behavior.

Key Tools for Mean Reversion Trades

Bollinger Bands

Bollinger Bands are like guardrails for prices. They show when prices are getting too high or too low compared to their average. When prices go outside the bands, it’s a signal that they might come back in soon.

Moving Averages

Moving averages are a simple but powerful tool. They smooth out price movements over time, making it easier to spot when prices are deviating from their average. When prices stray too far from the moving average, it suggests they might come back soon.

Applying Mean Reversion Strategies

Once you’ve found a mean reversion opportunity, it’s time to make a move. You can do this by buying or selling, depending on whether prices are too high or too low. The goal is to profit when prices revert back to their average.

Managing Risk in Mean Reversion

Mean reversion trading isn’t without risks. Prices don’t always behave as expected, so it’s essential to manage your risk carefully. Use stop-loss orders to limit your losses and diversify your trades to spread out your risk.

Real-life Example 1: Retailer Company RST

Imagine you’re a trader practicing mean reversion strategies, and you notice Retailer Company RST’s stock plummeting following reports of lower-than-expected sales figures. The market reacts swiftly, causing the stock price to dip below its usual level.

As a mean reversion trader, you interpret this sharp decline as an exaggerated response to the news. After conducting thorough research into Retailer Company RST’s financial health and market position, you decide to take action. Believing that the market overreacted to the negative news, you purchase shares of Retailer Company RST, anticipating a rebound in its stock price.

Over the subsequent days, your analysis proves prescient as Retailer Company RST’s stock gradually recovers. Investors regain confidence in the company’s long-term prospects, driving the stock price back towards its historical average.

By leveraging mean reversion principles, you’re able to capitalize on market fluctuations and generate a profit from Retailer Company RST’s temporary downturn.

Real-life Example 2: Forex Pair EUR/JPY

Consider a scenario where the EUR/JPY forex pair experiences a sudden surge in volatility due to geopolitical tensions in Europe. The uncertainty leads to a sharp increase in the exchange rate, pushing it significantly above its average level.

As a mean reversion trader, you analyze the situation and conclude that the spike in volatility is likely temporary. You decide to take a short position on the EUR/JPY pair, expecting the exchange rate to revert back towards its historical average as tensions ease.

In the following days, your prediction proves accurate as the EUR/JPY pair retraces its movement, returning closer to its usual level. By correctly identifying the mean reversion opportunity in the forex market, you’re able to profit from the temporary deviation in exchange rates.

These real-life examples illustrate how mean reversion trading can be applied across different financial instruments, allowing traders to capitalize on market inefficiencies and generate returns.

Common Hurdles and Solutions

Mean reversion trading has its challenges. Sometimes prices keep going in one direction, ignoring their average. To deal with this, it’s essential to be patient and wait for the right opportunities. It’s also crucial to be flexible and adjust your strategy as needed.

Testing and Tweaking Strategies

To improve your mean reversion strategy, test it out with historical data. See how it performs over different time periods and market conditions. You might need to tweak your strategy to get better results.

Mixing Mean Reversion with Other Methods

Mean reversion can be combined with other trading tactics for even better results. For example, you might use trend-following techniques to confirm your mean reversion signals or use fundamental analysis to find undervalued assets.

Conclusion

Mean reversion trading is a powerful tool for traders looking to profit from market inefficiencies. By understanding the principles behind mean reversion, using the right tools, and managing risk effectively, traders can potentially make money when prices revert back to their average.