Most online brokers want their clients to lose as little money as possible when they trade. Stop-loss orders are a type of exit plan that traders often use to limit their risk of losing more money.

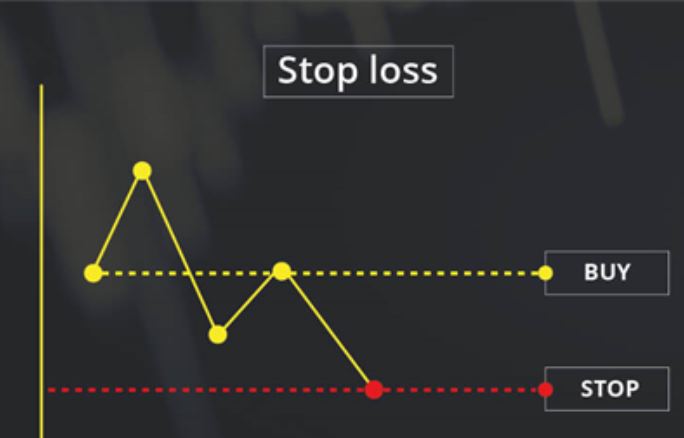

If the price of an asset goes below a certain level, the position will be closed at the market price.

How do stop-loss orders work for people who lost money?

Stop-loss orders limit traders’ losses by instantly getting them out of trades when the price moves against them. If you bought a currency thinking its price would go up (“taking a long position”), you could use a stop-loss order to close it and get out of it.

The stop-loss order will be carried out if the price goes below the level you set. If the price goes down, the trade will be stopped immediately to avoid losing more money.

If you were short as you thought the price would decrease, your stop loss would be above the current price.

What’s the purpose of stop-loss orders?

Unlike many of life’s more nice things, they don’t cost anything. It doesn’t cost anything to put in a stop-loss order. After the asset is sold and the stop-loss price is met, a commission is taken out.

Stop-loss orders also help traders who like to keep their eyes out of their trades as much as possible. Thus, stop-loss orders keep you from tracking a pair’s daily performance.

This helps you stay on track and keeps you from making quick choices that could cost you money. It also saves you from buying and selling the forex pairs based on your feelings.

Are stop-loss orders risky?

Like any other deal, stop-loss orders can go wrong. If a trader uses such a system, their loss is not just the difference between the sell and buy prices.

Even after the market closes for the day, the price of an asset could drop below the stop-loss price if the data released was worse than expected.

If the price goes below the trigger price of the stop-loss order and doesn’t go back up, the order will be carried out, and the asset will be sold. When the market is choppy, some risks could occur.

In a falling market, stop-loss orders could be a way for hedge funds to make money. This is an example of “stop hunting,” which is when traders sell short stocks whose prices are going down to make the prices go down even more.

How to decide where to put a stop loss when you trade?

Stop-loss orders for buying are usually at the bottom of the most recent trend. Also, if you are selling, put your stop loss above the high of the most recent pattern.

A stop order could be helpful if you want to buy or sell when it hits a specific price and is ready to risk a trade price that isn’t as close to your stop value.

Bottom line

Trailing stops are very risky. When used with standard stop-loss orders, they can greatly lower losses and protect profits simultaneously.