First thing’s first; what is a 0.01 lot size?

A 0.01 lot size means 1.000 units of any particular currency in forex trading. This is also called the Micro Lot, which we will discover later.

If your currency pair involves USD, the pip value is $0.1 per micro lot.

For example, if the price moves in our favor by 50 pips when you trade a GBP/USD currency pair, then 50 pips multiplied by $0.1 will profit $5.

Why Do We Need to Understand Lot Sizes?

This is done so that we can seamlessly comprehend our costs and risk-reward ratios.

To illustrate an example, consider a trade involving a currency pair’s movement by only one pip per week. And the lot size is $5, and so is the broker’s spread. There will be no profit as calculated using simple mathematics in this scenario.

If we open trade of 1 lot, we have to pay a commission of $50, resulting in us making only $5 a week. This phenomenon occurs because of the slow price variation of the currency pair.

Thus, to improve our cost-efficiency, we need to determine such a risk to reward ratio (and costs).

Basics of Forex Lot Sizes

An ordinary lot called the standard lot is about 100.000 units of any particular currency.

The only calculation required to find out how much 0.1 lot is to multiply 0.01 with 100.000, giving 1.000.

Below are familiar lots used in forex trading:

- A mini lot is 10.000 units.

- A micro lot is 1.000 units.

- A nano lot is 100 units.

A 0.01 lot in forex is a mini lot worth 1.000 units. So, the purchase of 1.000 euros means that 0.01 lots of EUR/USD were bought.

Pip Value per Lot Size

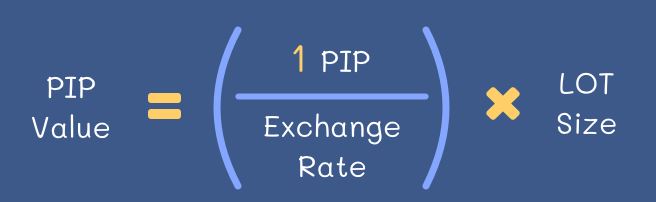

There is a set formula to calculate pip value per lot size.

The formula is specific to when we have different currency combinations – where USD is not the secondary currency (the quote).

This is: (1 pip / exchange rate) x lot size = pip value

The pip value that we receive from this formula is indicated as a base currency which is then converted into the currency of choice.

Pip Value and USD

For most traders like us, USD is our go-to currency, so we convert the calculated base currency into USD. But, of course, there is no need for conversion for cases where the base (first) currency is USD from the start.

Using the formula mentioned above with USD as the first currency, we now know that a pip value per standard lot is $10.

Similarly, a pip value per micro is $0.1.

Five pips on the pair EUR/USD means we spend $50 for every lot traded.

Bottom Line

It is vital to find out the number of pips charged every time a lot is traded.

We do this to verify our trading goes according to plan, so our capital does not go into commission. For beginner traders or others, then a 0.01 lot size is sufficient.