When trading currencies in the foreign exchange market, a trader initially registers for a trading account and deposits an amount. For the commencement of any trading activity, his deposit should meet a trading platform’s requirements.

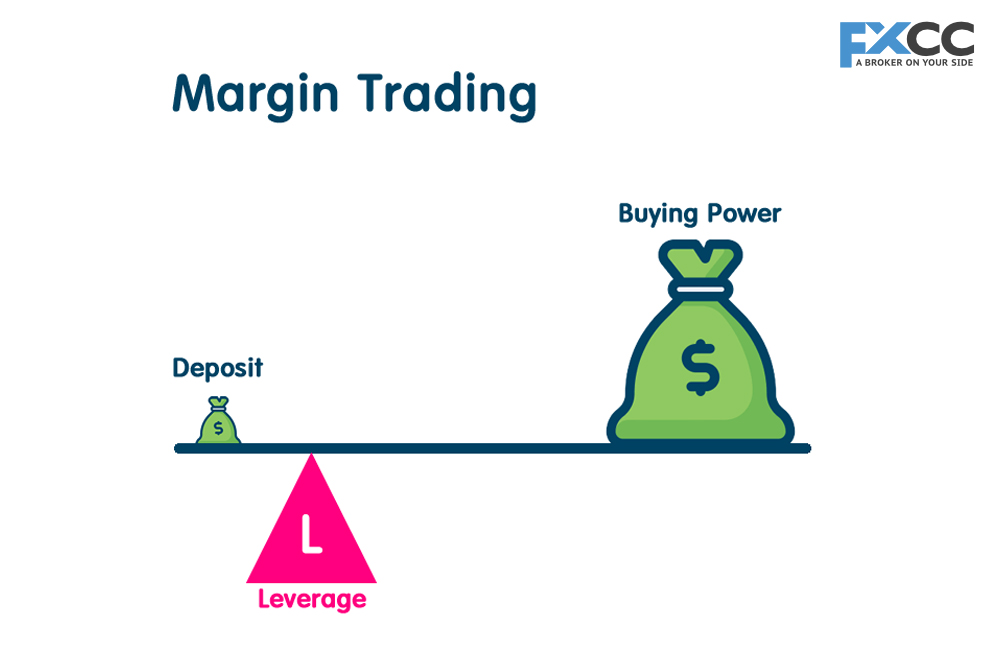

In the event that a trader is interested in engaging in further trades regardless of limited funds, he should know that trading opportunities (for the purpose) are available. For starters, he simply needs to register for a margin account.

Here’s a list of facts about margin trading:

1. One of the mistakes that can be committed by novice traders is the failure to understand the fundamentals of a margin account. They may be familiar with the fact that they could be margin traders and reach high positions for their forex careers; they are, however, unaware of the extent, limitations, and applicable penalties of a margin trade.

For one, they misinterpret what a margin is; for them, it is a transaction fee. However, by definition, a margin is neither a transaction fee nor a charge of any sort. It is usually set aside; it is an amount that serves as deposit.

2. Numerous trading programs were developed to promote smart monitoring of margin accounts. The developments address the issue that there are many instances when a trader ends up losing more money, regardless of having set more winning positions. Since these tools’ design revolve around monitoring and alerting a trader with regard to the activity in his margin account, the smart trading programs are very useful in boosting trading profitability.

3. When using margin accounts, a trader is required to be familiar with usable margin; it is mistakenly considered as the maintenance margin. Usable margin is the equity less than the used amount in a margin account.

4. For the maintenance of a margin account, an amount should be set aside; a minimum portion of equity (i.e. the value of investments in a margin account that is exclusive of borrowed amount) should be maintained. The amount is usually set by a margin account provider; in most cases, it is 25% up to 40% of the total equity.

5. Margin accounts are associated with margin calls; a margin call is in charge of notifying a trader of incoming risks to his margin account. For instance, he invests $5, 000 and uses it as security. If market exposure resulted to negative impacts and the $5,000-investment is at risk (i.e. it is about to be fully consumed), a margin call is initiated.