Many traders in our community will recall vividly the moment they became interested in technical analysis. Many will testify to the fact that it was moving averages that first peaked their interest. Perhaps we’d placed a 21 day moving average on a daily chart and witnessed how price reacted when it met this virtual barrier. Did it cross through it, was price rejected, did it move sideways in a range?

Many traders in our community will recall vividly the moment they became interested in technical analysis. Many will testify to the fact that it was moving averages that first peaked their interest. Perhaps we’d placed a 21 day moving average on a daily chart and witnessed how price reacted when it met this virtual barrier. Did it cross through it, was price rejected, did it move sideways in a range?

We then move up to looking at the hundred, or two hundred day simple moving average (SMA) after we’d constantly seen mention of them in articles published by Bloomberg or Reuters. We often saw quotes were the articles referenced analysts suggesting that price was near to, or had recently passed through, these virtual lines drawn on our charts. What did it mean?

The next natural progression is to place several of these moving averages onto a vanilla chart that has little else on it other than price represented by either a bar or line. We then observe many of the moving averages crossing on our daily chart. We note the lower 21 day SMA crossing the 50 SMA on a regular basis. Then a light is literarily switched on in our minds and we wonder if we could add a 10 day moving average to our rainbow of coloured indicators. We then note that as price moves up or down, in order to match bullish or bearish sentiment, the 20 crosses the fifty in what appears to be a correlated activity.

Our next stop is to ‘complicate’ the 10 day SMA a touch. Suppose we make it an EMA as opposed to a simple moving average. Now we note that the divergence, away from the higher moving average, is even sharper when we use the exponential version. It’s generally at this point in our trader metamorphosis that we begin to recognise that moving averages can in fact be quite powerful tools if used correctly. And there’s also the other key use which perhaps dominates their use over and above looking for price action and divergence thereof – where orders may be clustered.

The vision we have in our head of institutional traders is that they conduct their trading business, when buying and selling currency pairs, in a similar manner to us, but that they have banks of monitors to trade with and huge accounts to trade from. This vision is deeply flawed as the trading methods employed by institutional traders differ vastly from that practiced by retail traders.

It’s highly unlikely that the market movers and makers will use a combination of the MACD, PSAR, DMI, ADX and RSI to make their decisions, more likely their orders; buy, stop and take profit limit orders, will gravitate towards looking round numbers and key moving averages such as the 100 or 200 SMAs. Institutional level traders will have huge orders around key handles, such as we saw recently with the AUD/USD at the key critical level of 90.000. They’ll also have many orders clustered around the 100 and 200 SMAs.

Moving averages; their origins, use and calculation

Moving averages smooth the price data to form a trend following indicator. They do not predict price direction, but define the current direction with a lag. Moving averages lag because they are based on past prices. Despite this lag, moving averages help smooth price action and filter out the noise. They also form the building blocks for many other technical indicators and overlays, such as Bollinger Bands and the MACD. The two most popular types of moving averages are the Simple Moving Average (SMA) and the Exponential Moving Average (EMA). These moving averages can be used to identify the direction of the trend or define potential support and resistance levels.

A simple moving average is formed by computing the average price of a security over a specific number of periods. Most moving averages are based on closing prices. A 5-day simple moving average is the five day sum of closing prices divided by five. As its name implies, a moving average is an average that moves. Old data is dropped as new data comes available. This causes the average to move along the time scale. Below is an example of a 5-day moving average evolving over three days.

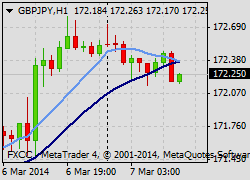

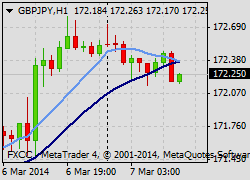

Moving average crossover trading concepts

A moving-average crossover occurs when plotting two moving averages each based on different degrees of smoothing, the traces of these moving averages cross. It does not predict future direction but shows trends. This indicator uses two (or more) moving averages, a slower moving average and a faster moving average. The faster moving average is a short term moving average. For end-of-day markets, for example, it may be 5, 10 or 25 day period while the slower moving average is medium or long term moving average (e.g. 50, 100 or 200 day period). A short term moving average is faster because it only considers prices over short period of time and is thus more reactive to daily price changes. On the other hand, a long term moving average is deemed slower as it encapsulates prices over a longer period and is more lethargic. However, it tends to smooth out price noises which are often reflected in short term moving averages.

A moving average is often overlaid in price charts to indicate price trends. A crossover occurs when a faster moving average (i.e., a shorter period moving average) crosses a slower moving average (i.e. a longer period moving average). In other words, this is when the shorter period moving average line crosses a longer period moving average line. In trading this meeting point is used either to enter (buy or sell) or exit (sell or buy) the market.

Where simple equally-weighted moving-averages are used is sometimes called a simple moving-average (SMA) crossover. Such a crossover can be used to signal a change in trend and can be used to trigger a trade in an automatic expert advisor trading system.

Comments are closed.