Trade Smarter, Win More: Building Your Path to Steady Profits

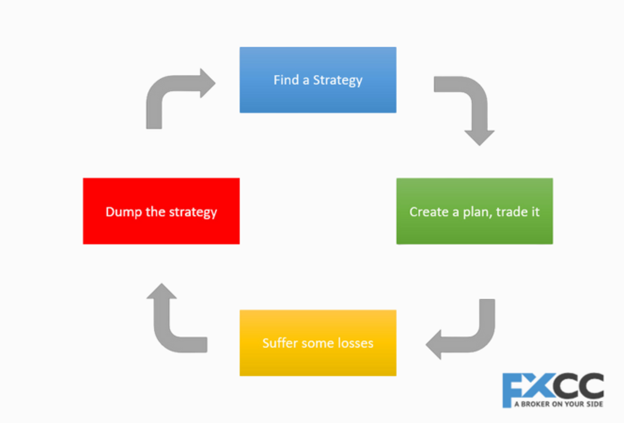

The stock market glitters with promises of riches and freedom. But let’s be real – getting rich quick is a fantasy. Building your way to steady profits requires a smarter approach, one that focuses on learning, discipline, and a clear game plan. This article will guide you on cultivating a trading edge, a set of […]

Trade Smarter, Win More: Building Your Path to Steady Profits Read More »