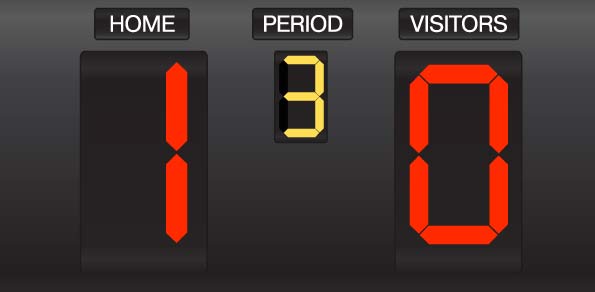

Argentina 1 Banking System 0. Are We Being Softened Up For A Drunk And Disorderly Greek Default?

It’s both fascinating and ominous in equal measures to watch the frayed nerves on show as we reach the end game for Greece and it is simply the end of the game, not the end of days. Perhaps Greece is simply being toyed with as the lab experiment for the overall greater experiment that is the Eurozone and the shared currency. Perhaps from this experiment the political and banking powers of Europe will be able to determine a plan for the other members who make up the numbers of the infamous and inglorious PIIGS. What is for sure is that we’ve run out of humorous metaphors for “kicking the can down the road” now.

Once you’ve done the “squashed, rusted can, trapped in the dead end of the cul de sac” description you know you’re out of metaphorical ammunition, just as the troika, Eurogroup and Greek politicians appear to be out of delaying tactics, or excuses…

Let’s be under no illusion that a Greece default will be a picnic, it’ll be the equivalent of economic hell for years, however, that’s assuming staying in the euro with such choke holds applied by the troika and private creditors would be an improvement. Already the measures put in place from 2010/2011 have wreaked economic devastation on the country and these measures, in order that Greece and indirectly the lenders could be bailed out, were the ‘lite’ version. Versions two and three, (version two being the latest), will have much harsher effects.

But can we look past the current situation and see a brighter prospect for Greece, do we have examples of huge economies defaulting and ‘coming back’ from the dead? Yes we do and it’s no surprise that these examples are not discussed. “Let’s not give the little people the impression that there’s light at the end of the tunnel, just get them to sign their fate in blood..”

It’d take up too much space on this blog entry to discuss Argentina and Indonesia, their defaults and rapid recovery, but as two very recent examples it proves that there is life after default. We’ll deliver a short précis on Argentina with particular emphasis on the similarity and differences in numbers…

There are obvious differences, Argentina ‘defaulted’ in the period from 1999-2002, the huge global boom that came afterwards was a tide that lifted all ships. Argentina had military rule, had suffered hyper inflation in the 1990’s, however from peak to trough the impact of the default lasted approximately three years. Many Greek citizens would suggest their economy has been in a zombie like recessionary state for five years and no time scale can be put on the inter-generational hardship Greeks could suffer as a result of staying in the Eurozone under the conditions currently outlined.

Although it was once the darling of investment banks and the International Monetary Fund, in 2001 Argentina suffered a lengthy recession culminating in the government halting debt repayments to its private creditors; a default on some US$95 billion in government debt, the largest sovereign default in history.

A highly overvalued exchange rate and an excessive amount of foreign debt were the two primary causes of the Argentine crisis. The negative trade imbalance caused by an expensive local currency made it impossible for the country to earn the foreign reserves needed to pay the interest on its foreign debt. Argentina had to keep borrowing to pay interest, the debt grew larger, reaching 50% of GDP by late 2001. Argentina could no longer borrow to meet its obligations, the government defaulted and devalued the peso, abandoning its former parity with the U.S. dollar in January 2002. The move shut Argentina out of international markets slowing the flow of investment into the country, with many creditors filing lawsuits against the government in courts. Eventually, the government struck a deal in 2005 to pay back approximately 75% of debt-holders at a deeply discounted rate of 30%.

In June 2010, Argentina tried to restructure what remained of the debt with similar conditions to the one in 2005. This debt swap had a participation rate of approximately 70%, which, added to the previous restructuring, led to a total level of 90%. In order to gain total access to international capital markets, Argentina needs to settle its outstanding debt with the Paris Club nations approximately US$7.5billion. On November 15, President Fernandez announced that the Argentine government and the Paris Club reached an agreement to start the renegotiation of the debt, on the condition proposed by Argentina and accepted by the Paris Club that there would be no intermediation by or presence of the IMF in the process.

In summary Argentina’s default, after a severe economic crisis, sparked social unrest and runs on banks. It presented creditors with a take-it-or-leave-it offer of 35 cents on the dollar. They considered this derisory: previously, delinquent countries had typically paid 50-60 cents. But the government stood firm and roughly three-quarters of the bondholders took part in a debt exchange in 2005. More joined in 2010, bringing the total to 93%.

The economy of Argentina is Latin America’s third-largest, with a high quality of life and GDP per capita. An upper middle-income economy, Argentina has a firm foundation for future growth for its market size, the levels of foreign direct investment, and percentage of high-tech exports as share of total manufactured goods. The country benefits from rich natural resources, a highly literate population, an export-oriented agricultural sector and a diversified industrial base.

[unordered_list style=”tick”]

- GDP $435.2 billion (nominal, 2011)

- $710.7 billion (PPP) (21st, 2011)

- GDP growth 9.2% (2011)

- GDP per capita $10,640 (nominal, 2011)

- $17,376 (PPP) (51st, 2011)

[/unordered_list]

Market Overview

Equities have fallen, the euro weakened for a fifth day and commodities declined as Europe’s leaders remained divided over a Greek rescue and Moody’s Investors Service said it may downgrade global banks. The cost of insuring government debt against default rose to a one-month high.

The MSCI All-Country World Index slipped 0.7 percent at 10:05 a.m. in London. The Stoxx Europe 600 Index fell 0.8 percent, led by banks, and Standard & Poor’s 500 Index futures lost 0.4 percent. The euro declined to less than $1.30 for the first time since Jan. 25 and Spanish 10-year bonds dropped for a third day, sending the yield 11 basis points higher.

Societe Generale SA sank 3.4 percent in Paris after France’s second-largest bank said fourth-quarter profit declined 89 percent as the investment bank posted its first loss in two years.

Market snapshot at 11:00 am GMT (UK time)

Asia Pacific markets suffered modest falls in the overnight early morning session, the Nikkei closed down 0.24%, the Hang Seng closed down 0.41%, the CSI closed down 0.53% and the ASX 200 closed down a significant 1.68%. European bourse indices are down in the morning session. The STOXX 50 is down 0.89%, the FTSE is down 0.59%, the CAC is down 0.41% and the DAX down 0.94%. The ASX is down 1.94%. ICE Brent crude is down $0.03 a barrel whilst Comex gold is down $9.10 an ounce. The SPX equity index future is down 0.35%.

Currency Spot Lite

The euro declined to a three-week low versus the dollar as European leaders were divided over a rescue for Greece. The 17-nation currency fell for a fifth day versus the greenback before German and Italian leaders meet tomorrow ahead of a finance ministers’ gathering next week to decide on a second bailout package for Greece. The dollar rose after Moody’s Investors Service said it’s reviewing banks including UBS AG and Credit Suisse Group AG for possible downgrades.

The euro declined 0.5 percent to $1.2998 at 9:11 a.m. in London after sliding to $1.2983, the lowest level since Jan. 25. The common currency weakened 0.1 percent to 102.40 yen. The dollar gained 0.5 percent to 78.78 yen.